Challenges

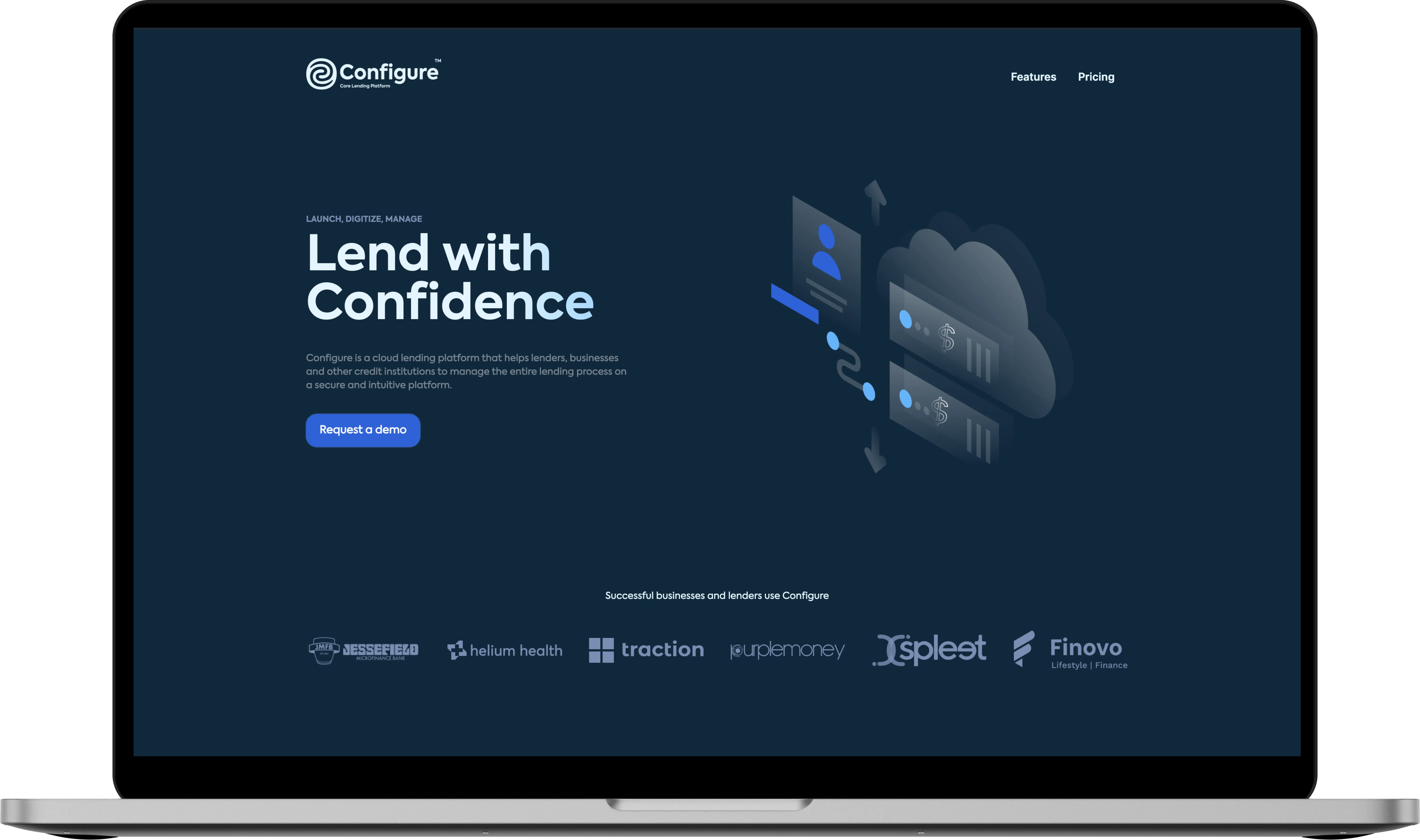

Implementing MicroFrontend architecture for scalable application development.

Ensuring secure authentication and role-based access control for different financial institution roles.

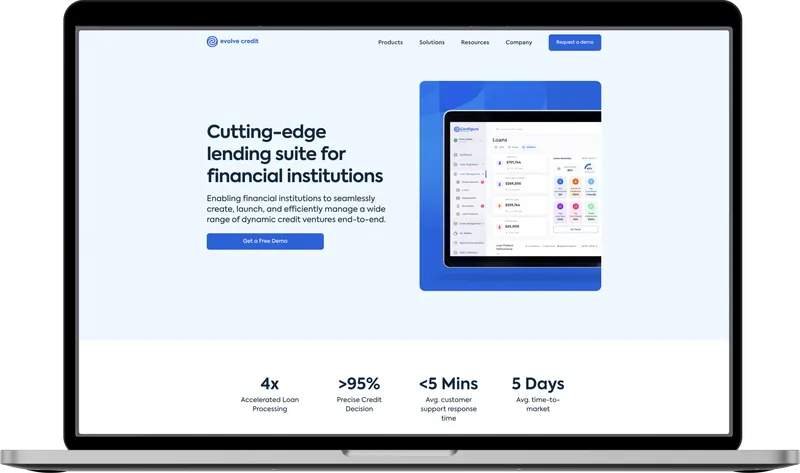

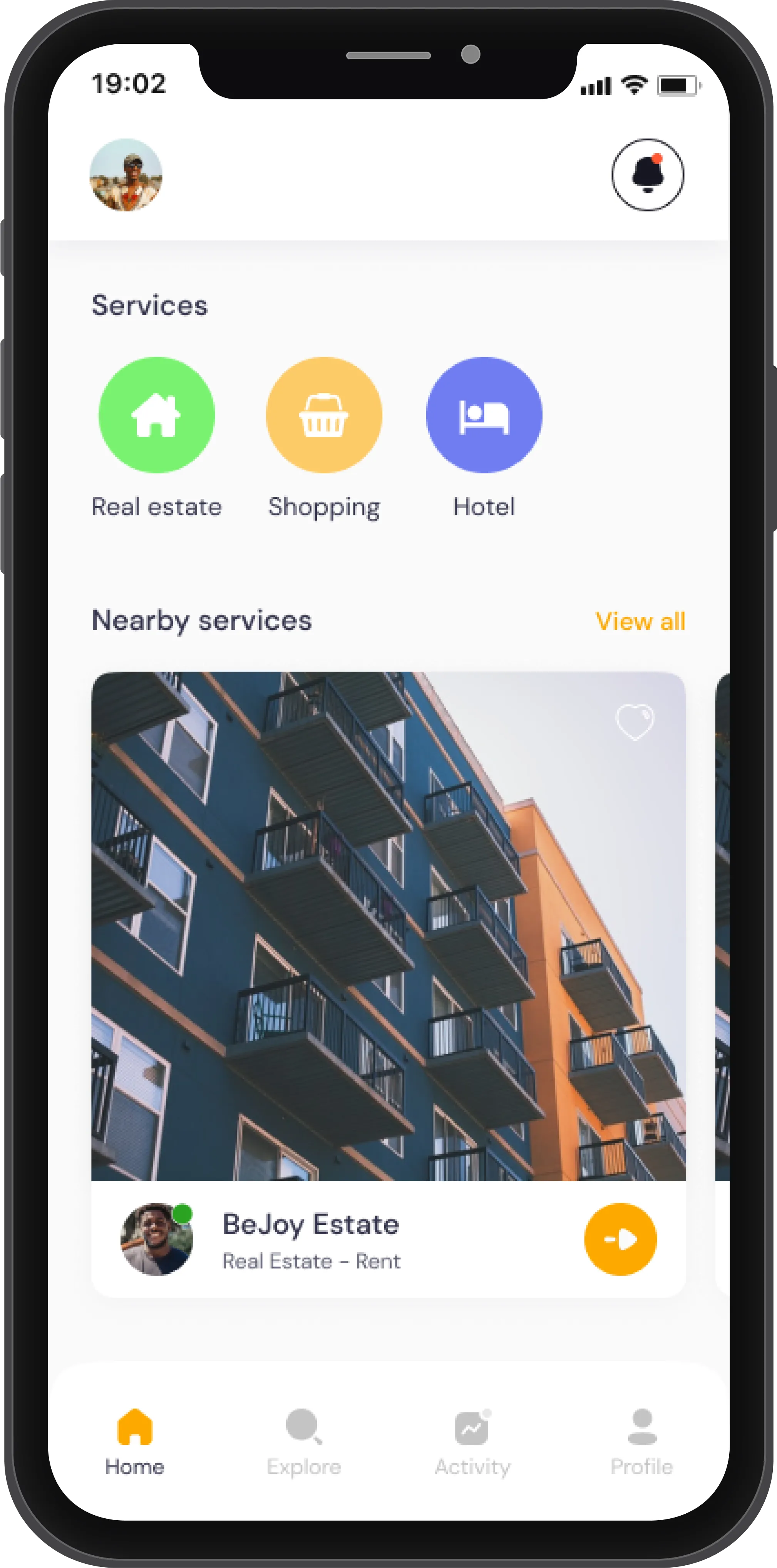

Optimizing the application for performance and responsiveness across various devices.

Integrating GraphQL for efficient data fetching and API communication.